Ideal Present Value Excel Template

It gathers the data of the estimated cash flows in the future by dividing them into discount rates to.

Present value excel template. Companies can use the professional net present value calculator excel template to help easily decide whether the investment will add value in a long time. As illustrated b we have assumed an annual interest rate of 10 and the monthly EMI Installment for 30 years. Calculating Net Present Value NPV using Excel.

Some other related topics you might be interested to explore are Present Value Cost of Capital and Internal Rate of Return. Adjusted Present Value Excel Template 0 9939. Adjusted present value APV is the sum of the net present value NPV of a project and the present value of debt financing costs.

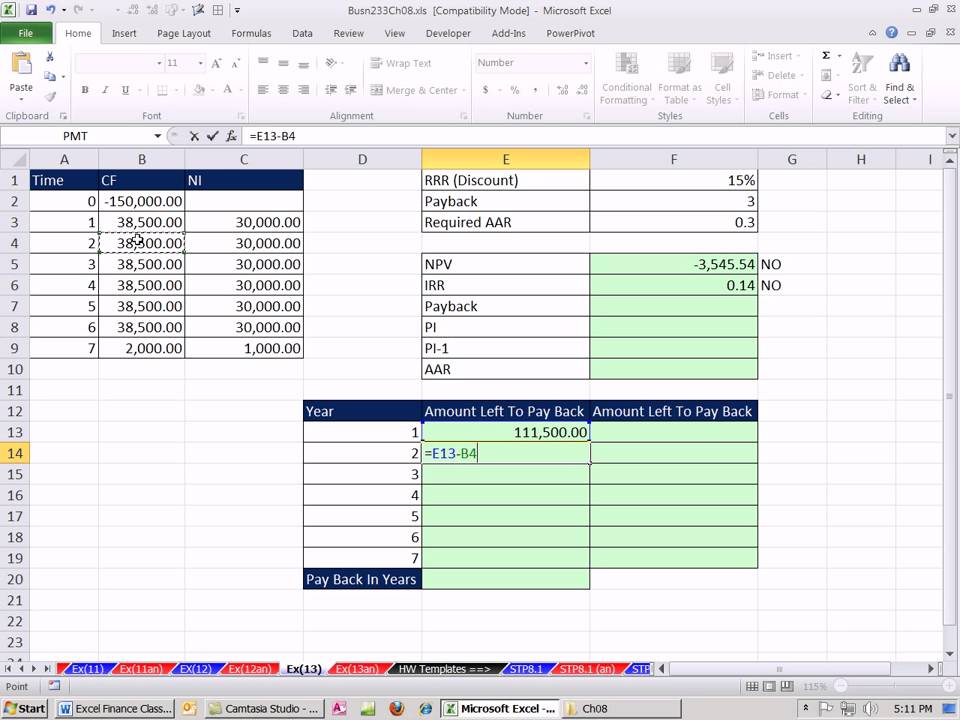

At the same time youll learn how to use the PV function in a formula. In finance it is simply not enough to compare the total amount of money to estimate and evaluate cash flow. Here is a screenshot of the net present value template.

The Excel PV function is a financial function that returns the present value of an investment. This adjusted present value template guides you through the calculation of APV starting with the value of the unlevered project and PV of debt financing. For example project X requires an initial investment of 100 cell B5.

Say that somebody offering you an investment where you have to invest USD 10000 for 4. It is commonly used to determine the value of a debt-financed project or a company. The present value of the investment rounded to 2 decimal places is 1232891.

Below is a preview of the adjusted present value template. This is important because it factors in the time value of money and the associated interest and opportunity costs. FV of an Annuity.